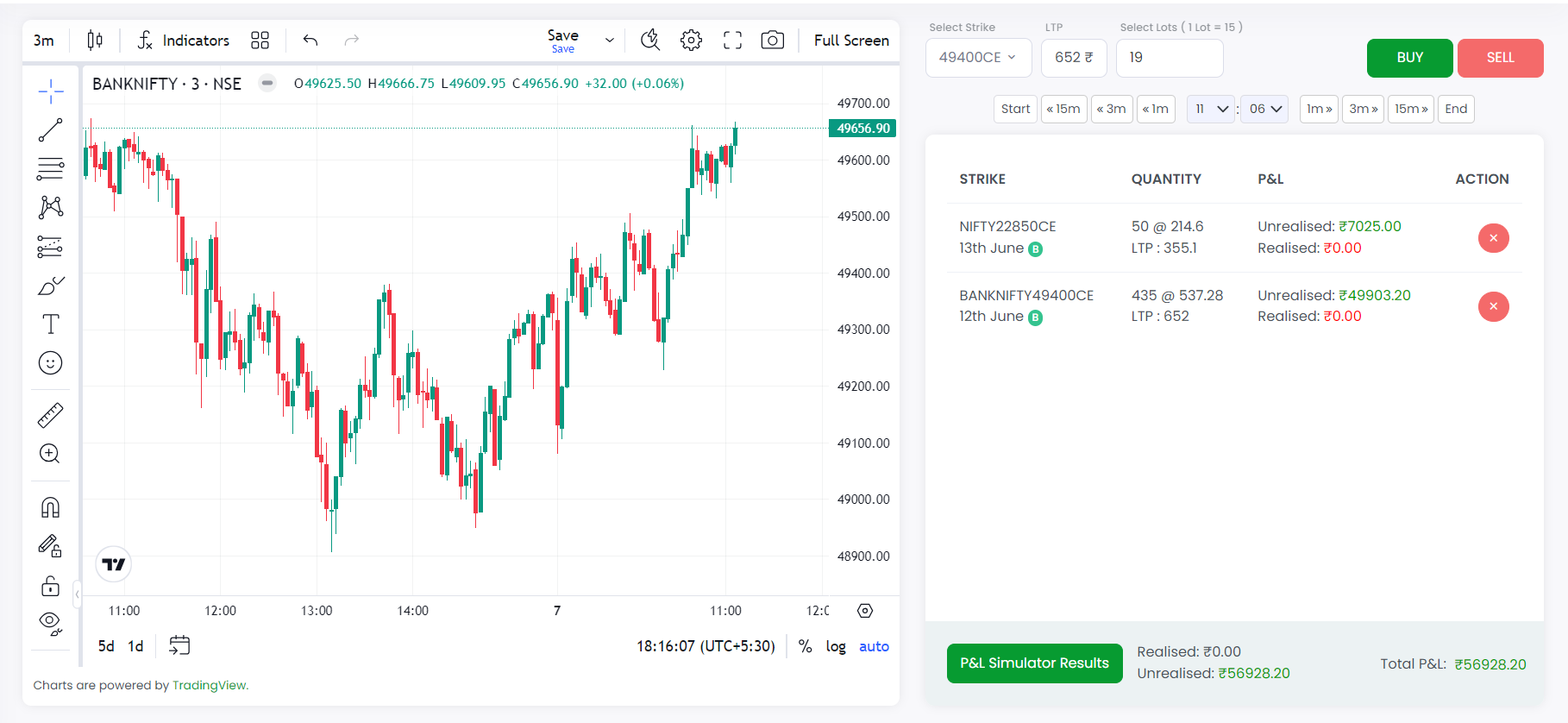

You may have observed many times where an

option priced at Rs. 2.00 escalates to Rs. 100.00, a phenomenon that

typically occurs around the expiry period and particularly on expiry

days. This dramatic price movement presents an opportunity for

traders to secure profits through strategic position hedging.

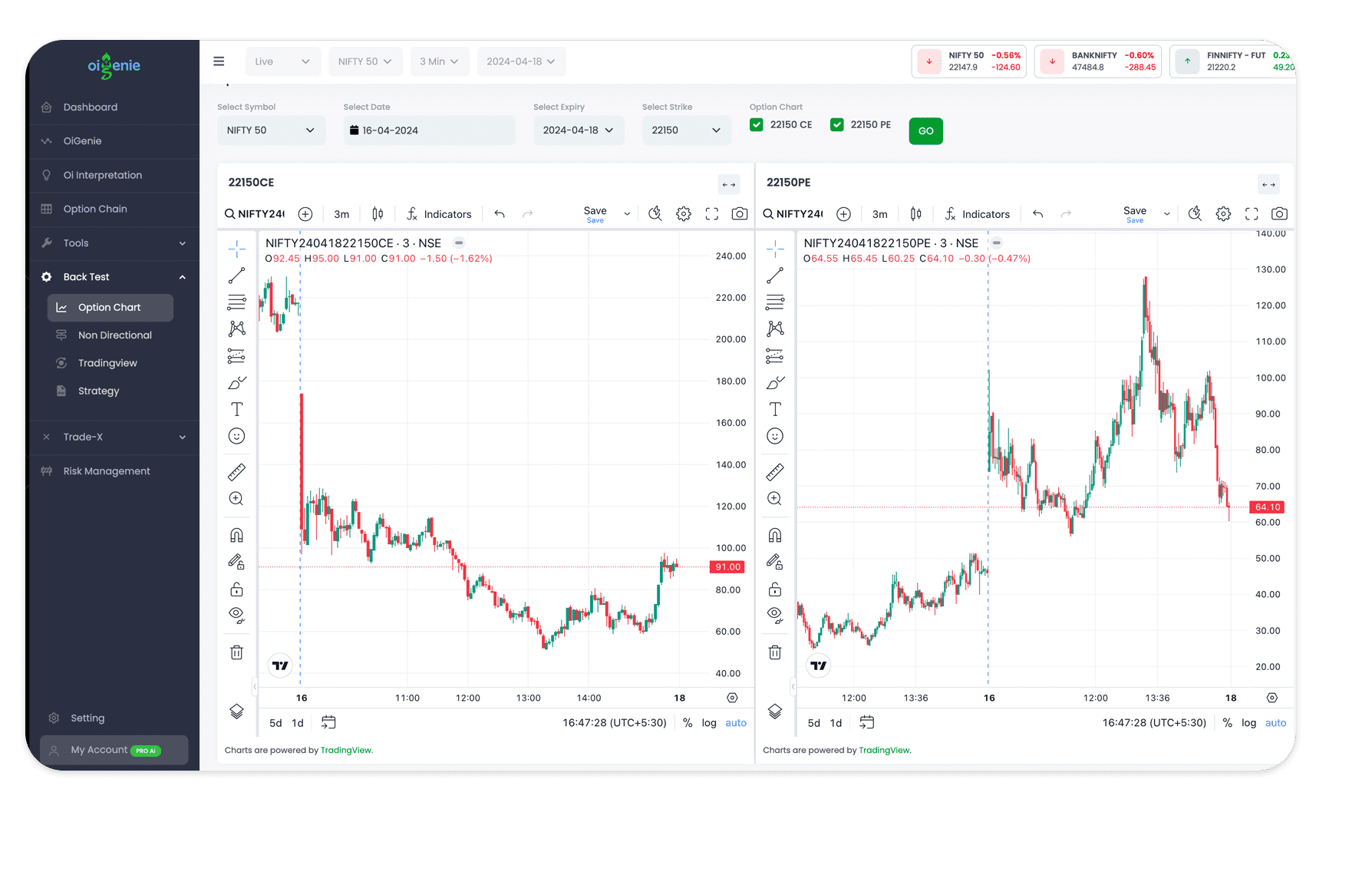

In this context, backtesting strategies

like the long straddle and long strangle becomes invaluable. The

long straddle strategy involves simultaneously buying a call and put

option of the same underlying asset, strike price, and expiration

date, betting on significant price movement in either direction.

Similarly, the long strangle strategy involves purchasing call and

put options with the same expiration date but different strike

prices, anticipating a major price swing.

By backtesting these strategies, you can

analyze historical data to predict their potential profitability

under similar market conditions, thus preparing for future

opportunities to exploit the price surges seen during expiry and

near-expiry periods.