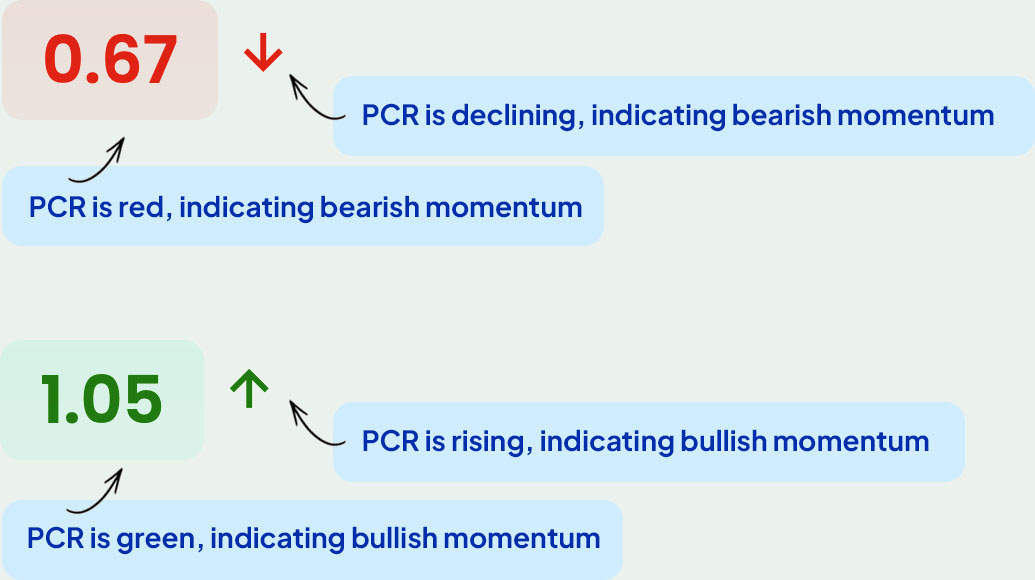

PCR

The Put-Call Ratio (PCR) is used to

measure the overall sentiment of the market. It is calculated by

dividing the total number of traded put options.

(Put Oi) by the total number of traded

call options (Call Oi).

PCR > 1: Indicates a bearish sentiment,

with more puts traded, suggesting expectations of a market decline.

PCR < 1: Shows a bullish sentiment, with

more calls traded, implying an anticipated market rise.

Rising PCR: A rising PCR suggests bullishness in the market.

Declining PCR: A declining PCR suggests bearishness in the market.

Declining PCR: A declining PCR suggests bearishness in the market.

PCR should be used alongside other

indicators for a comprehensive market analysis.