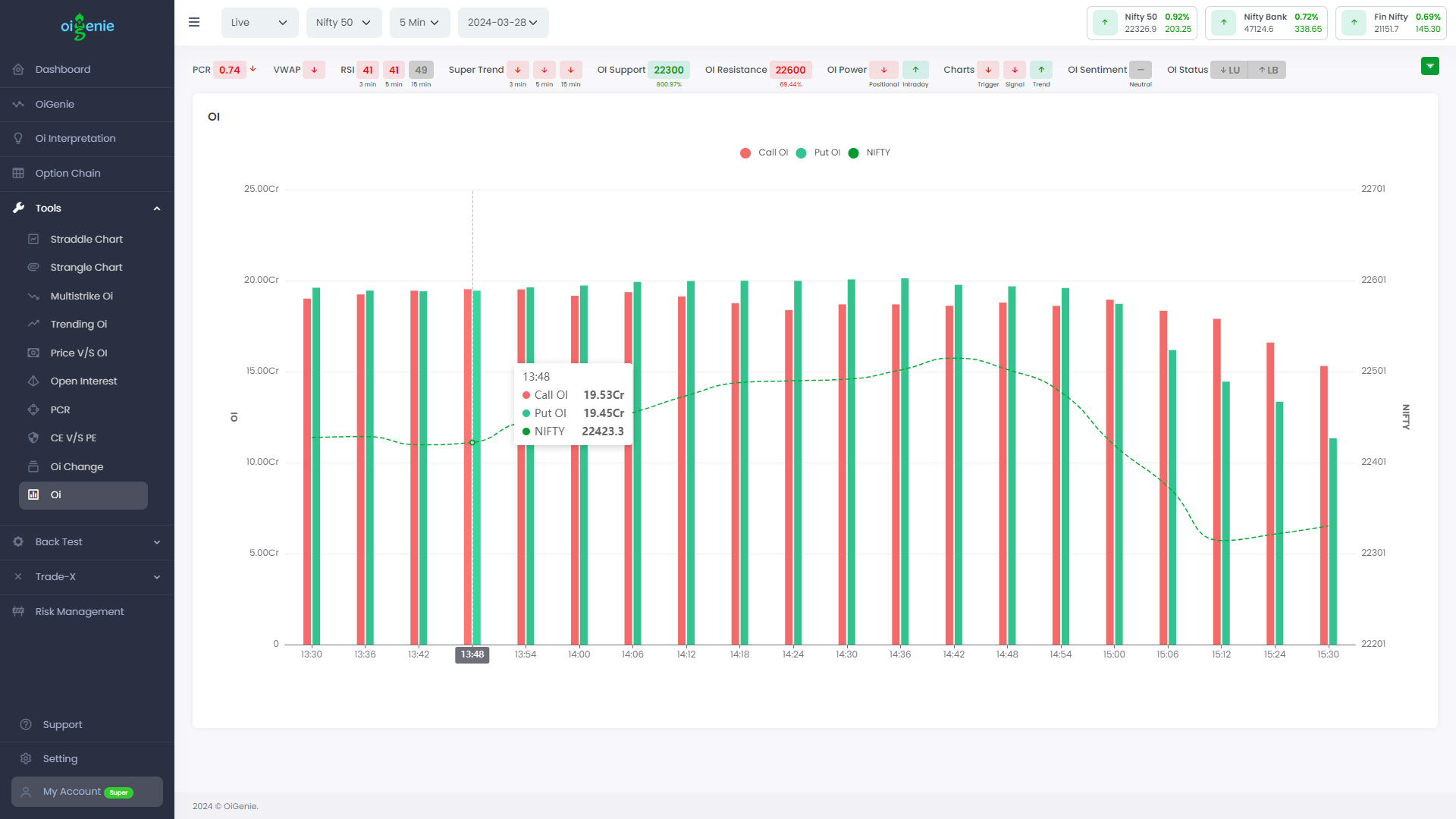

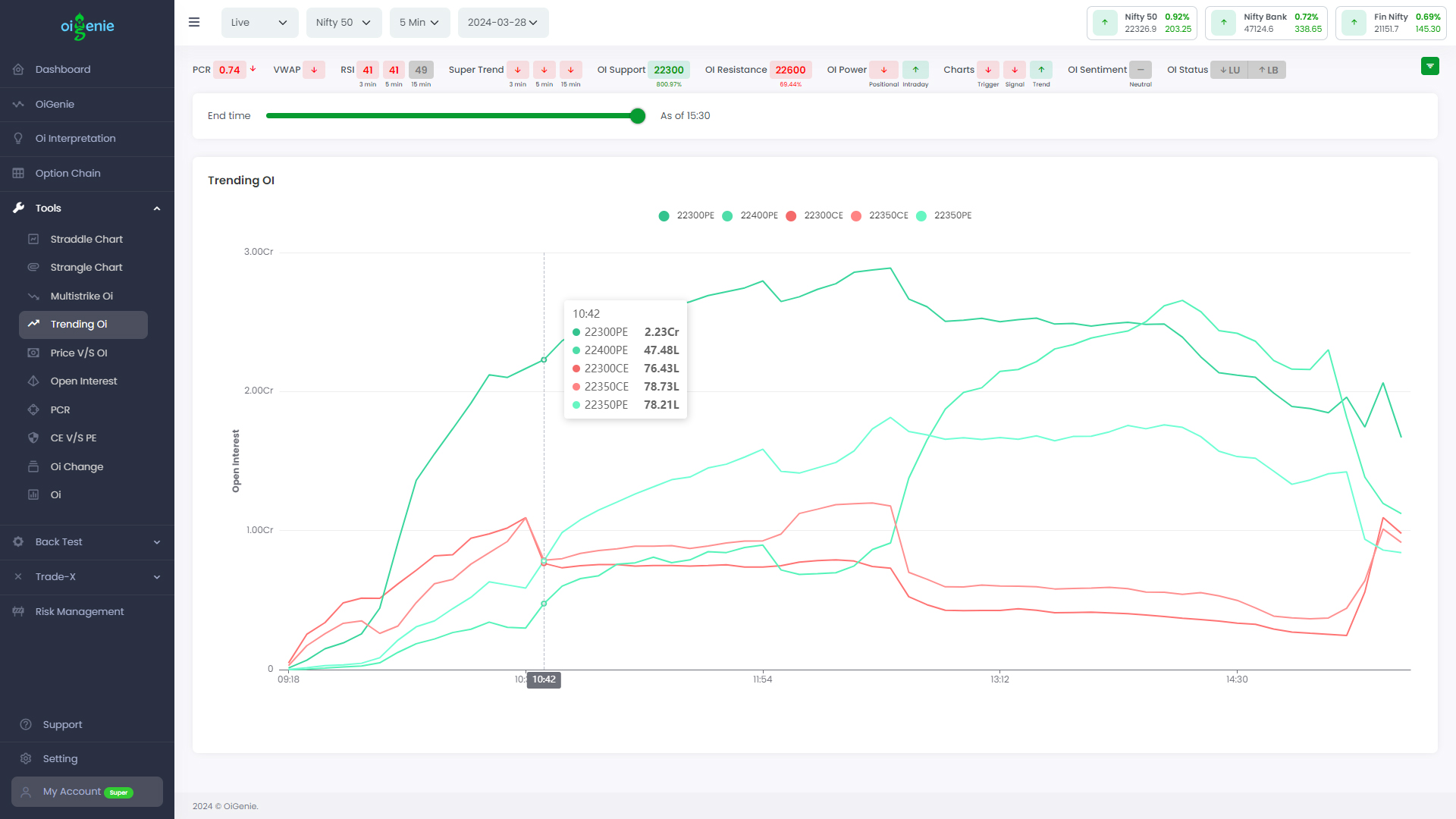

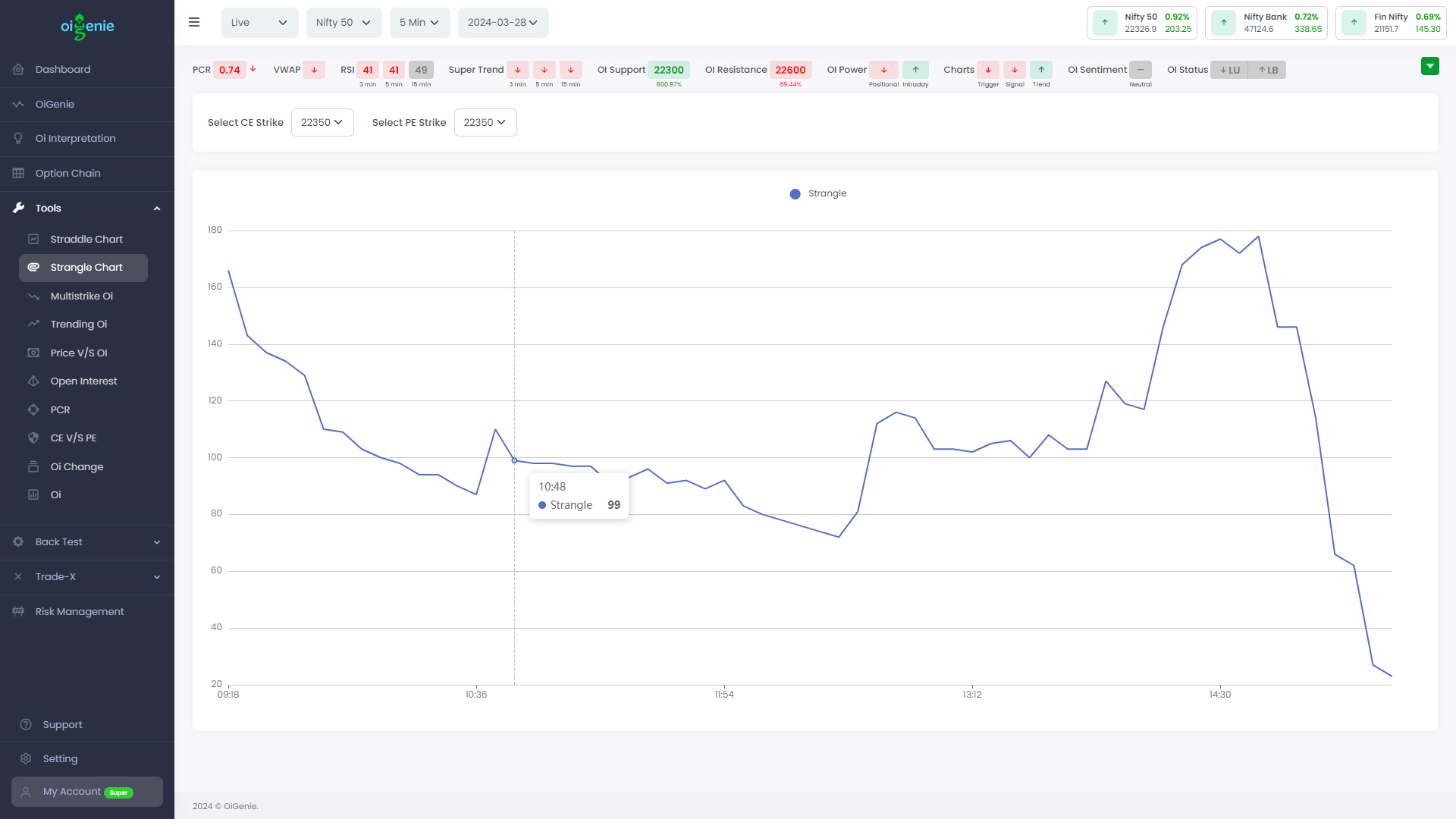

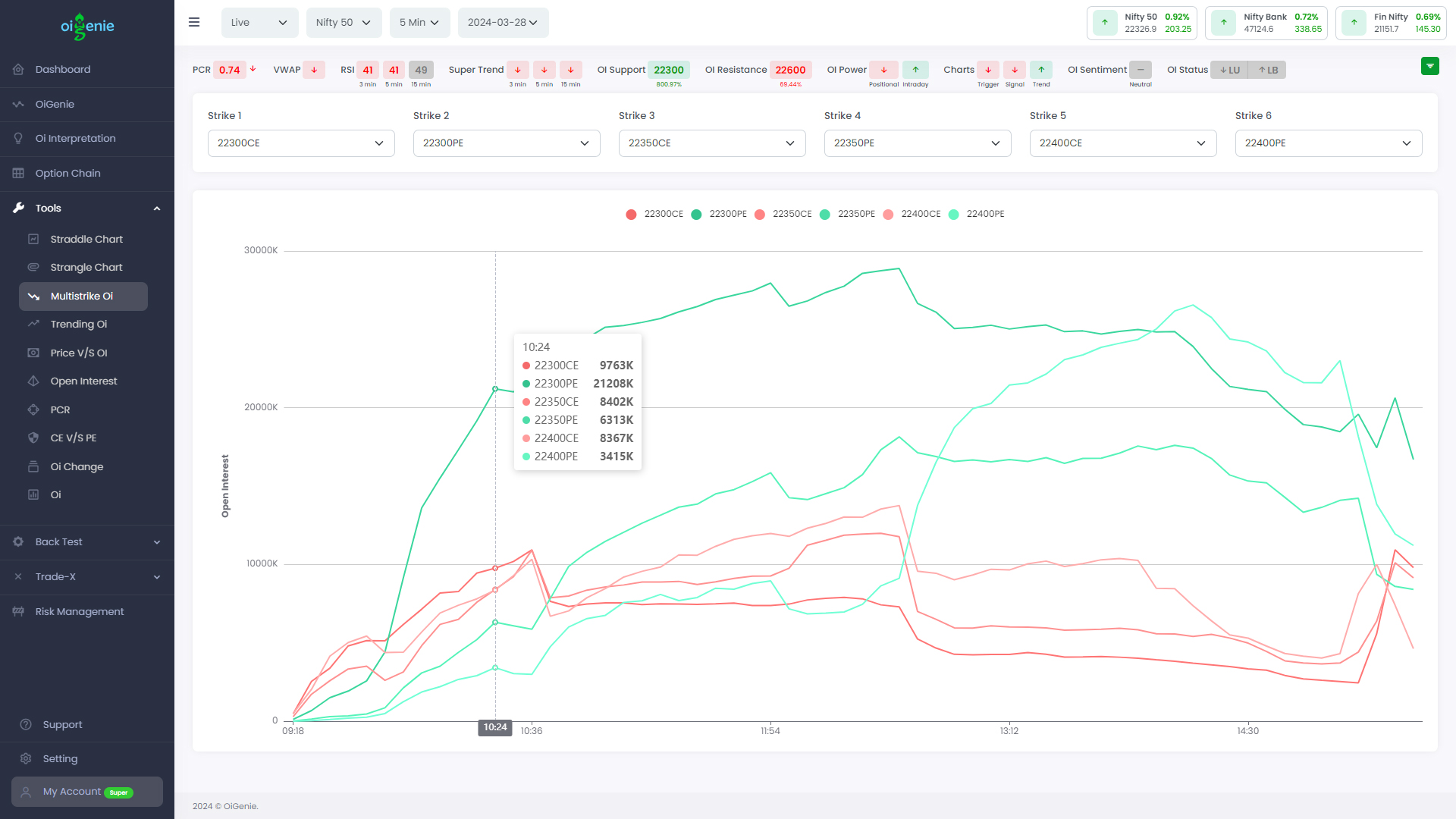

Oi Chart

View the Call Oi and Put Oi alongside the

asset's price in a chart format for a clear visual representation of

market trends. This comparison can help identify whether bullish or

bearish sentiment predominates and forecast potential market

movements.

A sudden decrease in Call Oi combined with

an rise in Put Oi signals a market reversal towards bullishness.

Conversely, a sudden increase in Call Oi and a decrease in Put Oi

indicate a market reversal towards bearishness.