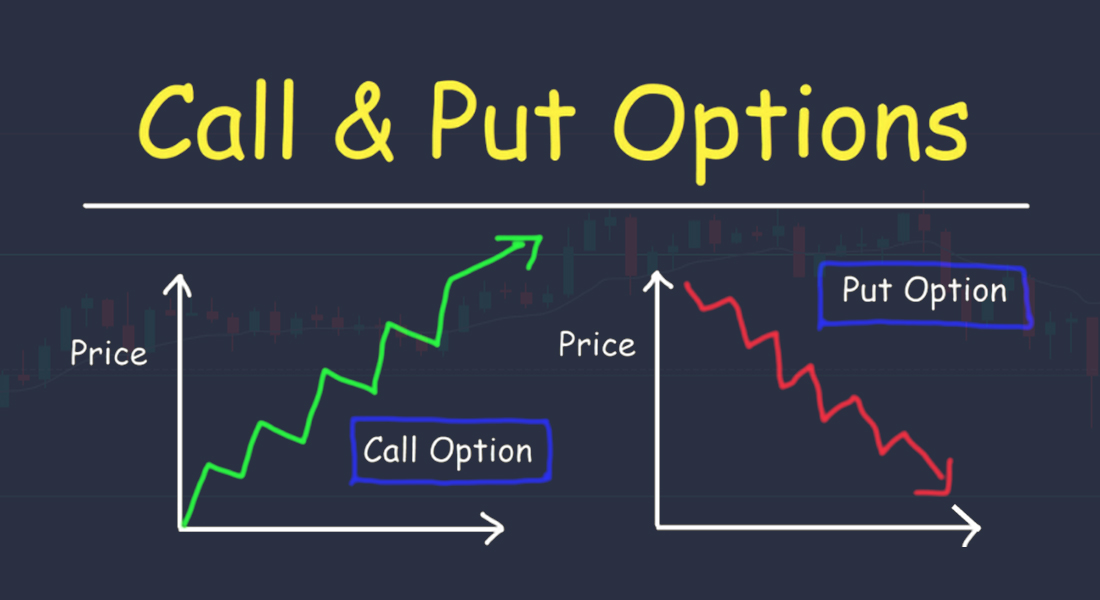

For a call option, you profit if the market price of the stock goes up above the strike price before the option expiration date.

Whereas, for a put Option, you profit if the market price of the stock goes down below the strike price before the option expiration date.

So, in simple terms:

- Call Option = Profit when the market goes up

- Put Option = Profit when the market goes down

How Does a Call Option Work?

Imagine you want to buy a particular stock, but you’re not sure if the price will go up or down in the near future. A call option gives you the right to buy that stock at a predetermined price (called the strike price) within a specific time period.

- You pay a fee (called the premium) to buy the call option contract.

- The contract specifies the strike price (the price at which you can buy the stock) and the expiration date (the last day you can exercise the option).

- If the market price of the stock goes above the strike price before the expiration date, you can exercise your option to buy the stock at the lower strike price.

- After buying the stock at the strike price, you can immediately sell it at the higher market price, making a profit.

- If the market price doesn’t go above the strike price before expiration, you can choose not to exercise the option, and you’ll only lose the premium you paid for the contract.

How Does a Put Option Work?

A put option gives you the right (but not the obligation) to sell a stock at a price (called the strike price) within a specific time period.

- You pay a fee (called the premium) to buy the put option contract.

- The contract specifies the strike price (the price at which you can sell the stock) and the expiration date (the last day you can exercise the option).

- If the market price of the stock falls below the strike price before the expiration date, you can exercise your put option to sell the stock at the higher strike price.

- After selling the stock at the strike price, you’ve made a profit because you sold it for a higher price than the market price.

- If the market price doesn’t fall below the strike price before expiration, you can choose not to exercise the option, and you’ll only lose the premium you paid for the contract.

Risks Involved In Call and Put Option:

Call Option Risks:

- When you buy a call option, the maximum amount you can lose is the premium you paid for the contract. If the stock price does not go above the strike price before expiration, your call option becomes worthless, and you lose the entire premium paid.

- If the stock price rises significantly above the strike price, you may miss out on potential gains beyond the strike price since you don’t own the underlying stock.

Put Option Risks:

- Similar to call options, when you buy a put option, the maximum you can lose is the premium paid for the contract. If the stock price does not fall below the strike price before expiration, your put option becomes worthless.

- If the stock price falls sharply below the strike price, the option writer may choose to assign the option to you. In this case, you would be obligated to buy the stock at the strike price, which could be higher than the current market price, resulting in an immediate loss.