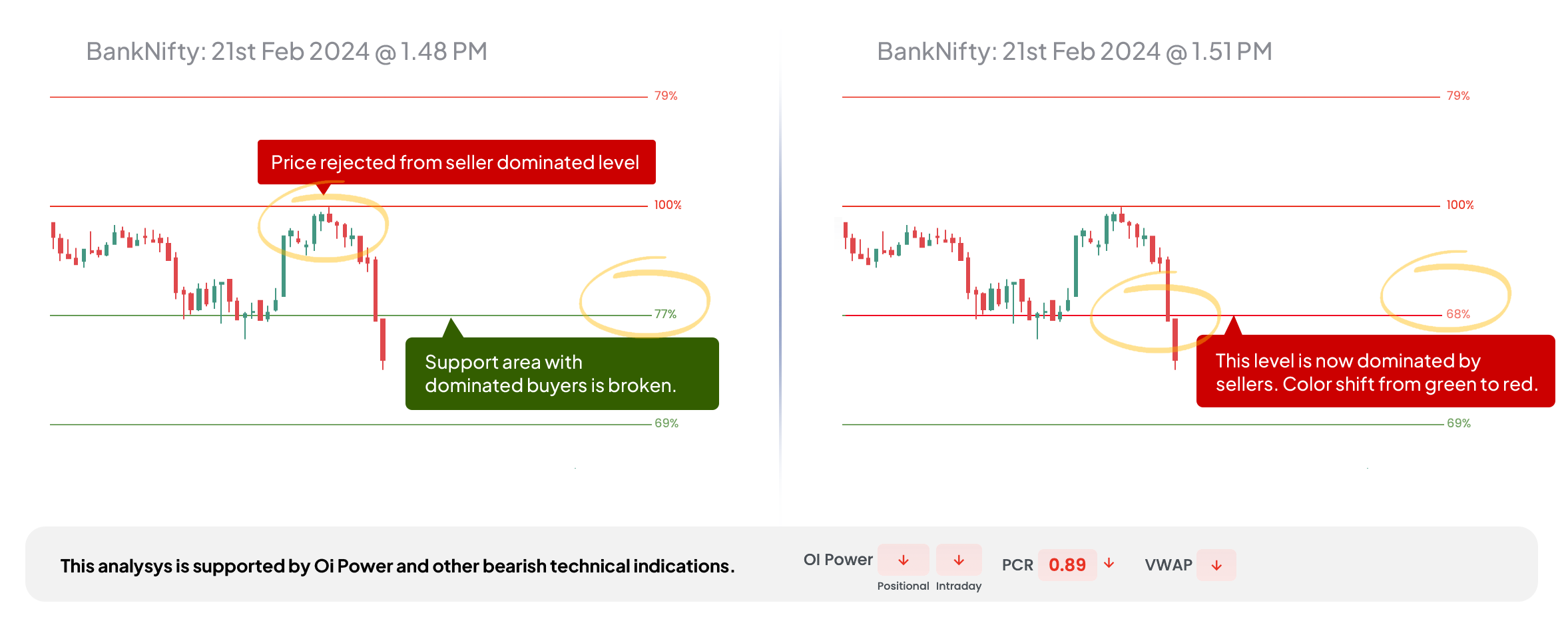

Breakout confirmation

Many traders lose money when they get trapped by fake breakouts.

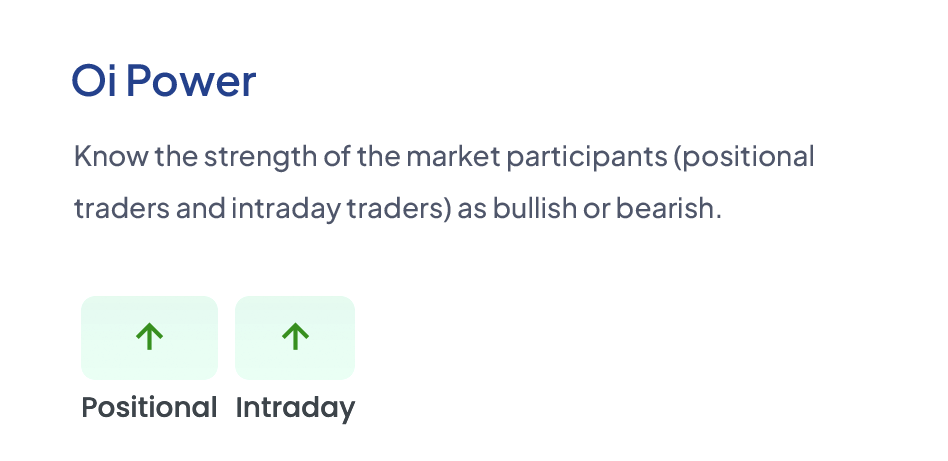

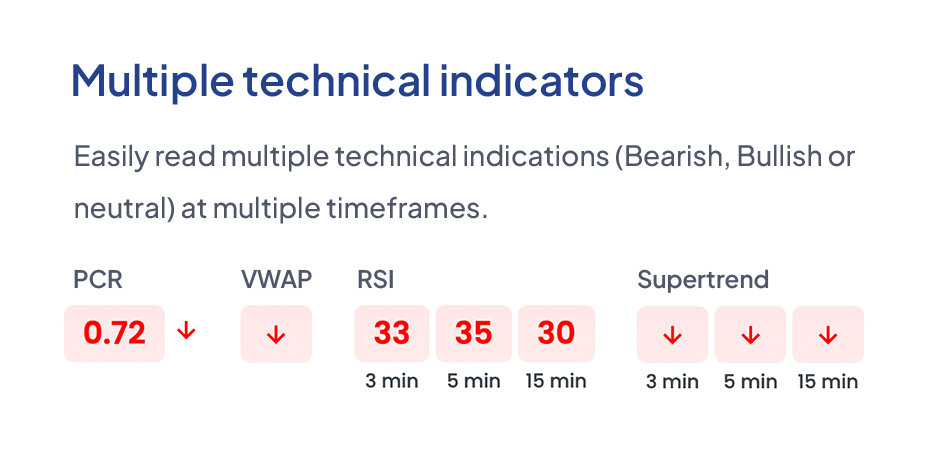

The behavior of market participants at a crucial support or resistance level decides a breakout or breakdown. OiGenie makes it easy to identify the real breakouts.

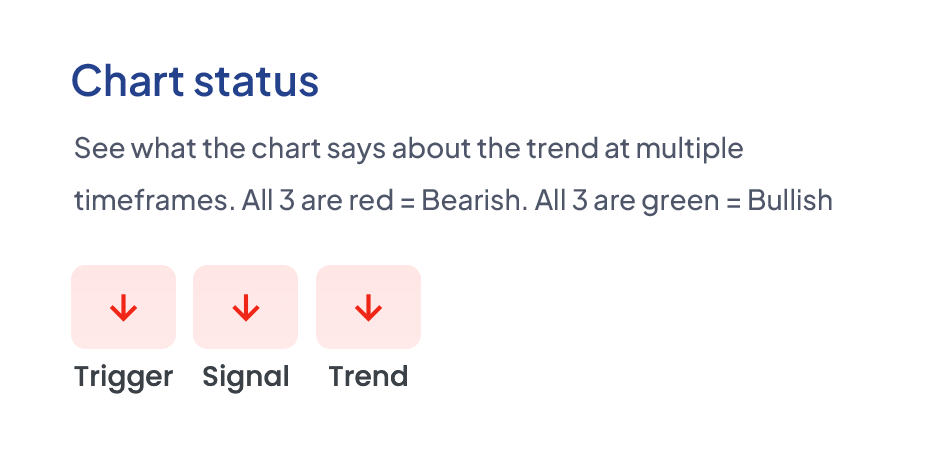

Identify strong trending days.

It happens many times when you exit the trade, the trade continues to move in the same direction, and you miss big profits.

OiGenie has the brain to identify strong trends so that you can hold on to your trades for big profits. The OiGenie Bar and the Genie levels confirm the strong trend.

Identify ranging days.

Many option buyers lose money due to theta decay during ranging days where the price consolidates or stays in one area.

OiGenie detects the ranging days by indentifying buyer seller sentiments.

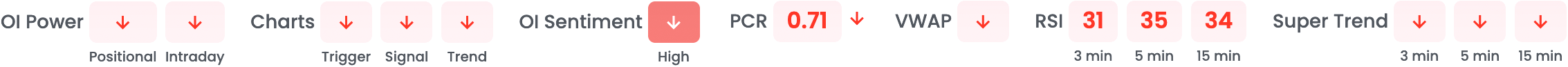

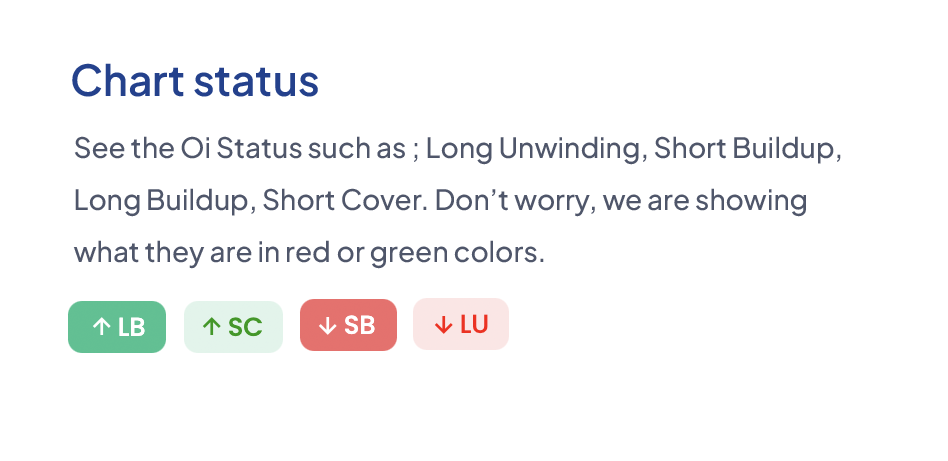

Automatic support and resistance levels + their importance

You can see where the market participants are sitting at and OIGenie automatically highlights the importance of certain levels where the price may bounce or reject.

This makes it easy for the traders to see the levels and take the decisions accordingly, be it taking new trades or taking profits or close the trades.

Oigenie Bar

You can see where the market participants are sitting at and OIGenie automatically highlights the importance of certain levels where the price may bounce or reject.

This makes it easy for the traders to see the levels and take the decisions accordingly, be it taking new trades or take profits or close the trades.

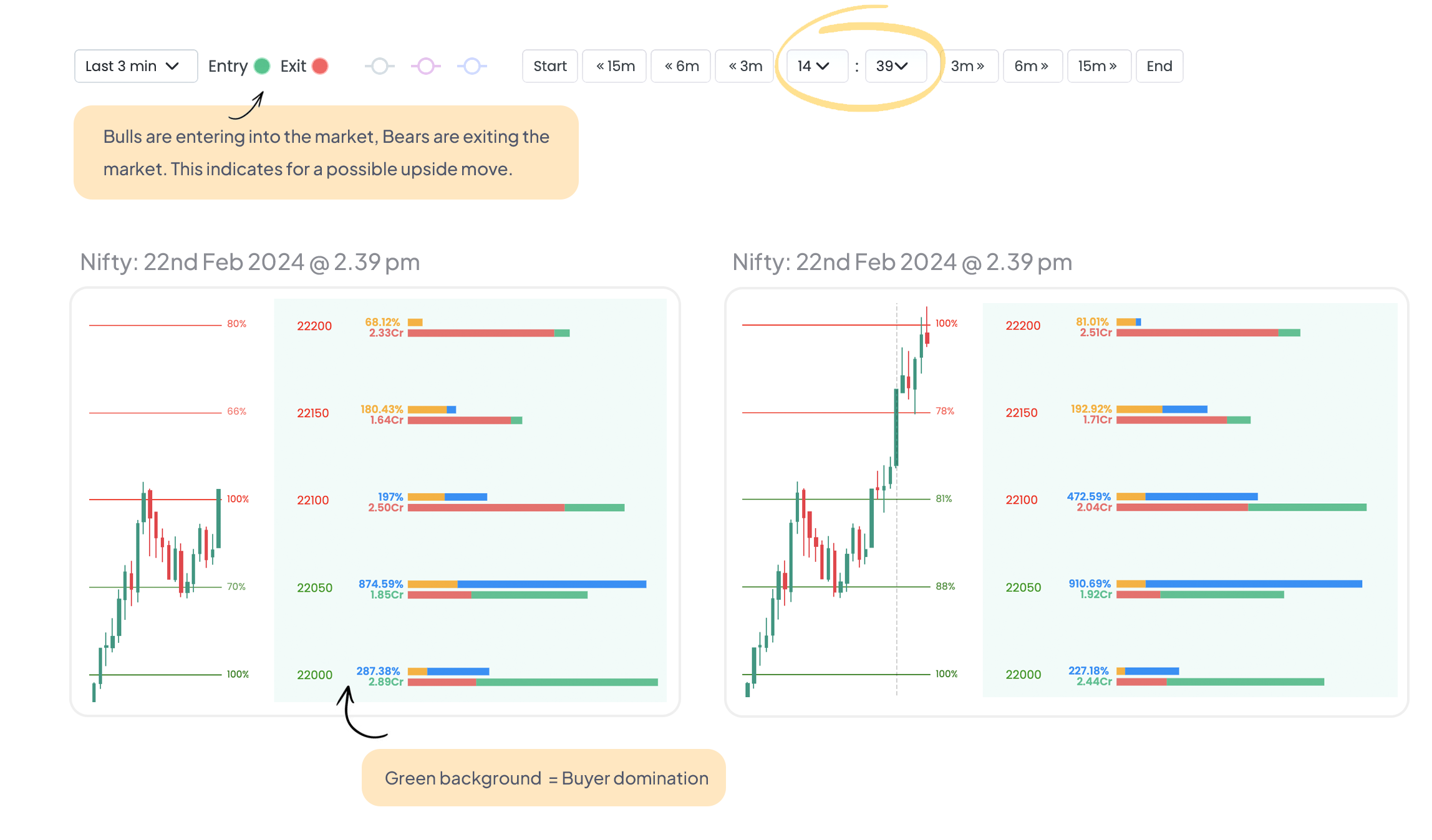

It is a time machine :) Compare market participant information by going backwards.

OiGenie has the time machine of the option chain. You can go backwards and see the behavior of the market participants by comparing the data.